Writing

Writing

An important piece that we bypassed in our first four lessons was the development of writing.

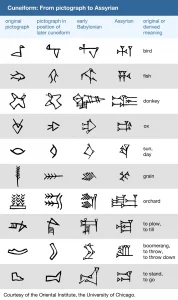

Writing began in about 3,200 BC, in Sumer. At first it involved fairly obvious symbols for things like trees, houses and so on. Symbols for verbs were simple images like a foot for “go.” In this chart you can see how such symbols developed over time:

What’s interesting about the development of writing is that it came from accounting. Back as far as 8,000 BC, tokens were used as receipts and/or for counting in upper Mesopotamia. Step by step, this use continued and expanded. As rulership grew (and with it the extraction of animals and grain from farmers), these clay tokens were used as receipts (proof) for their tax payments.

As writing began, it was used, overwhelmingly, for accounting, and particularly for payments to and from rulers. But from there, thankfully, it spread and found many other uses.

And, as we noted in Lesson 3, the Phoenicians later turned symbol writing into alphabet writing, the kind we still use.

What’s also of interest about writing is that it spread from Sumer to the rest of the known world almost instantly. That indicates how much long-distance trading was being done, because these traders (like, perhaps, Otzi) spread not only goods, but information.

Money

It’s harder to say when money began. As we noted earlier, obsidian may have been a very early form of money, though we can’t yet be sure of that. But very certainly, the use of credit goes back much farther than the use of money itself.

Credit is simply an effect of human action. One family grows a surplus of grain, but needs tools to do so. Making such tools, of stone or metal, was probably done by people specializing in it: very certainly some people were better at it than others, and some people lived in places where better raw materials were available. And so trades were arranged, like this:

If you give me four nice sickle blades now (because I need them now), I’ll give you three baskets of grain at harvest.

And, as we say often, long-distance traders were continually involved in such things. (And for them, obsidian would have been an excellent tool for carrying value from place to place.)

This type of credit was apparently universal in the ancient days, but money as we understand it began when rulers – and again beginning at Sumer – made themselves the guarantors of all debts.

As we covered earlier, at the center of Sumerian cities were temple complexes, to which grain was brought by farmers. The rulers of the time (kings and/or priests) had to trade this grain for other things: soldiers and weapons most of all. Making barter trades for all of those things was difficult.

Within this situation, being the enforcer of all debts worked very well for the ruler. For one thing, he became the owner and operator of a legal system, giving him or them standing to oversee and even overrule commercial transactions. For another, the ruler could (and apparently did) enforce a standard of value. In Sumer, that standard of value was silver. The rulers owned far more silver than anyone else, and they decided legal cases by specifying how much silver was involved in each settlement. That gave them tremendous advantages.

The big trick, however, was turning receipts for debts into currency. Currency does not mean the same thing as money. Properly, money has value in itself, while currency is a receipt for something of value.

But since the ruler was the guarantor of all debts, he would make sure the receipts he signed would be honored. And so those receipts became useful for transferring value. They were far easier to move around than sheep or baskets of grain, and the king would make sure they were honored. And so currency began.

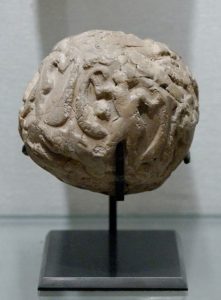

The Sumerian rulers did all these things. Here, for example, is an “envelope.” Inside were the records of debts, and outside was a summary of them. Such an envelope, or a receipt for it, could be used as currency, and would be enforced (backed) by the ruler.

This same model of using debts as money continues through our time. The Bank of England, for example, was founded precisely this way. In 1694 King William III was low on funds, and so he borrowed 1.2 million pounds from a group of men, authorizing them to use debt certificates from the loan as currency. In other words, they used IOUs from the king as money. (Or, more properly, as currency.)

The same principle was used when setting up the first central bank in the United States. When promoting the new bank, Alexander Hamilton, its founder, wrote this:

It is a well known fact, that in countries where the national debt (money owed by the ruler) is properly funded and trusted, it answers most of the purposes of money. Transfers of stock or public debt are therefore equivalent to payments in silver or gold.

**

Paul Rosenberg

freemansperspective.com

* * * * *

Please take a look at our subscription letters. You can review the back issues here and order here.