I’ve touched upon this subject in my subscription newsletter, but I had no plans to write anything more until I got a note from a friend, mentioning a particular investment analyst and his views on investing over the next few years. I had to agree that it was brilliant analysis, but at the same time I knew that I’d never do anything about it, because I simply can’t bring myself to put money into “the markets” anymore.

I’ve touched upon this subject in my subscription newsletter, but I had no plans to write anything more until I got a note from a friend, mentioning a particular investment analyst and his views on investing over the next few years. I had to agree that it was brilliant analysis, but at the same time I knew that I’d never do anything about it, because I simply can’t bring myself to put money into “the markets” anymore.

As a young man I spent time learning the nuts and bolts of investing: Price to earning ratios, book values, charting, puts, calls, covered positions, and so on. And when I had extra money, I tended to put it into the markets and use my tools. But I can no longer do that, and I think explaining why may be useful.

There are three reasons for this conviction of mine, and so I’ll list them below. But I’m listing them in reverse order, because reason number one stands above the others: By itself it would prevent me from investing in the usual way. I think all three reasons are strong, but reason number one is pivotal.

Reason #3

Reason number three is simply that the markets no longer make sense. In fact, I’ve now taken to calling them “exchanges,” not wishing to denigrate the concept of markets.

The technical tools the eager young men and women of previous generations used no longer hold. They were never perfect, of course, but now they are superfluous: What central banks and governments buy go up, and that’s almost the end of it. There are complexities and complications, of course (corporate buy-backs are second-order effects of zero-bound interest rates rather than direct actions), but the essence of the matter is clear enough.

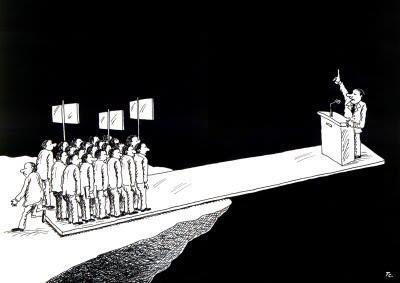

The factors driving prices are no longer those of voluntary participants; rather, they are the actions of a small elite who stand out of sight.

And so I’ve lost all trust in the market actions we used to assume. They still hold in black markets and in the cryptosphere, but not in the government-regulated markets. Does anyone still believe that European bond markets are driven by fundamentals?

I know people are going along because it’s the only big game in town, but that strikes me as insufficient cause.

Reason #2

Reason number two is simply that the big “markets” are not just relics of the past, but have become enemies of the future. Let’s be honest and admit that 401Ks and other pension vehicles are compliance tools, directed toward the partly-moneyed class. They tie people to the status quo and penalize leaving it.

It used to be that markets were fairly democratic operations, in that prices were determined by the uncoerced actions of millions of people. That was never entirely the case, of course, but there was substantial truth to it. That, in turn, left markets open to progress: the doors were not shut to something new and frightening to entrenched interests.

Now, unfortunately, the situation has radically changed; business people must be ideologically pure in order to thrive. Mike Lindell of My Pillow makes a perfect example: He produces a product that people like and he conducts honest business. And yet, his advertising is banned by the status quo because of his political opinions. That is direct tyranny; it is anti-market, anti-liberty, and anti-future.

This is what has happened to the markets over the past few generations, and Lindell is but one example. The “markets” are no longer markets; they’ve become appendages of a totalitarian system, and I no longer want to play.

Reason #1

The deep reason that free markets matter is not economic, but moral. What matters most is not that free markets work (even though they do), but that they are the only moral way for humans to arrange their affairs. Everything else involves coercion; everything else minimizes human growth and development.

The financial advisor my friend noted had figured out how to benefit from the abuse being hurled at business by the “green” regulations that are being forced upon Europeans, and which will follow to North America if possible. And again, the analysis was accurate.

What, however, is the benefit of profiting from the abuse and semi-enslavement of millions of people? Shall we be proud of our cleverness and brag about it at cocktail parties? Is “number go up” all there is?

I fully understand about being desperately in need of money: Been there, done that. And so I’m willing to cut plenty of people plenty of slack in that regard; but where does it end? Once we have enough to be comfortable, do we still scratch and claw for every dollar, trying our best to believe that maximization is a worthy goal?

I won’t go much further on this (see The Narrowing of Capitalism if you’re interested in more), but the idolization of markets that began in about 1980 gave investors a way to avoid moral concerns: Private commerce, free market, case closed. Except that even perfect markets can’t cleanse bad actions: Markets are neutral platforms; the only morality they have is the morality we bring to them.

My point here is that the best possible ROI (return on investment) isn’t an automatic virtue, and a large number of investments in “the markets” support abuse and even death.

Easier for me to say than the young and desperate, I know, and so I’m not trying to cast stones. But still, someone needs to say this.

We all draw our lines in different places – very little in this world is completely pure – but pretending there are no lines to be drawn is clearly wrong. Injecting morality into a market is our job; if we don’t do it, it won’t be done.

And so, that’s why I’ve left the investment exchanges. “What, then, shall I do with my money?” is another question, and I’m not going to address it today. Beside, it’s not that hard to answer, once you want an answer.

**

Paul Rosenberg

freemansperespective.com

Totally Agree Paul.

We left the corrupt market years ago for these exact reasons.

We don’t have a lot of money, what we have is in Bitcoin with a little in remote land.

Thank you Paul for your continued wisdom and truth.